The Product Probe: Is Zoom fighting a losing battle?

Zoom – the product that propelled a business to be worth $160B in a $7B market, all because the product ‘just worked.’ It actually wasn’t that long ago that Skype was the video conferencing tool of choice, and you were lucky if 50% of the conversation made it across the line. So the fact that Zoom made this very difficult technical challenge simply work was a minor miracle. It worked in New York City, it worked in the Amazon Rainforest; it worked with new, shiny devices, it worked with old, crummy devices; it worked lightning connections, it worked with shoddy connections. It just worked.

Today, Zoom is a $20B company doing over $4B in revenue annually and is profitable, has 75% gross margins and has bought back over a billion dollars of its own stock in the past year. The product still works, plus it has a million other features. Yet the share price is as flat as the highway I drove down this morning.

The Zoom mission is “to empower people to accomplish more through video communications” and I believe this is causing them some serious problems. The main problem is no one actually wants to use video conferencing. It’s a means to an end. None of the myriad new features land a sizeable punch for growth because, well, no one wants to use the product. This has led to a very confused product strategy over the past 4 years and has even threatened their main strength – being the platform that just works.

But first, let’s look at how a company in a $7B market ended up becoming a $160B company.

A $160B company in video conferencing you say?

Enabling video communication across borders is one of the internet’s finest accomplishments. Companies have been trying to tackle this problem since the beginning of the internet, but it’s always just sucked (for a comical branded reminder of these issues, this Zoom ad is worth watching). There was a clear problem there that needed solving and Eric Yuan (the founder) was the perfect person to address it.

Eric, a genius in his own right, had worked at WebEX and Cisco on video products and had lived the problem himself (living in the US with his family in China). He was so loved in his previous roles that almost all the developers he worked with followed him to build a new video conferencing platform from scratch. And this is exactly what the army of engineers did.

This was by no means an easy challenge. Complications arise everywhere in this technology. Audio and signal processing is one small part of a video call and is years of work on its own, reducing background noise (but not losing any words of the speaker), video performance, echo issues, interoperability with different webcams, various room shapes and backgrounds, different skin tones, conflicting networks and network strengths. These are all big challenges when you’re telling an inanimate object (a computer) what to do.

The fact that Zoom had gone and done all of these by 2017 was impressive, and the fact they did them before 2020 and the lockdowns around the world coming into play, was extremely fortuitous. Suddenly, video conferencing went from a nice-to-have product that saved companies on business travel, to a must-have that every day centred around. The forced increase in usage (plus some good old fashioned inefficient stock markets) is how Zoom’s value went up 10 times in less than a year. And that’s how they became a $160B company.

Now that things have normalised, Zoom is back to being a $20B company – a much more sensible valuation. This is a market size of $7B and they have already captured 57% of the market share.

The fact that Zoom’s mission is still very much focused around video conferencing is limiting the share price, and it’s the cause of a very confused product strategy. Video conferencing is never something you necessarily want to do, it’s always a last resort.

Video calls that ‘just work’ still kind of suck

Video calls are a significant improvement on a phone call, but they aren’t a replacement for human contact.

If you live on the other side of the world and you’ve just had a baby, you can dial your parents into meet the little one – amazing. But if you could choose, you’d definitely prefer to be in person at this time. And now if you’ve got one meeting in NYC when you’re based in LA, you can save the thousands of dollars, time and hassle and do this over video. But again, in a perfect world, you’d be doing this in person. Group meetings for remote workplaces also save businesses hundreds of thousands a year, but are the people in the meetings getting the same experience. There are actually studies done that prove that video conferencing meetings lead to significantly lower stimulation and engagement. The point is, no one is waking up in the morning jumping out of bed to get on their first Zoom.

Video conferencing is not a natural experience – it’s forced. Each video call has a specific purpose and you are there for that. The small chat and off-hand comments that are so important to human connection are sorely missed on a video call. Only one person can chat at a time so the louder people win, and you’re not able to read the audience when you’re telling a long story. Plus there’s no way to break off into a side conversation when you find a mutual interest with someone else on the call.

But Zoom’s mission is solely focused around this behaviour, and I believe it’s why their share price has languished, and their product strategy looks as confused as Michael Vaughn used to look every time he got out (this is a cricket analogy for anyone that’s lost).

The confusing product strategy

At Zoomtopia 2018, Eric Yuan said they were trying to simplify their product experience. Let’s have look at the home screen when you enter the product, and the main call screen – the two places you’re supposed to be spending most of your time. You tell me if you think this looks like a simple experience.

Zoom is one of a host of companies that are trying to dominate the work day of a customer. They don’t all sound like direct competitors but Slack, Notion, Canva, Microsoft, the Atlassian group (Jira, Confluence etc) and Google are all building tools that they want knowledge workers to sit in all day. The theory goes like this: the more time they can get people using the product per day → the more the product is embedded in the users’ lives → the more they’ll be able to monetise in the long-term.

The issue for Zoom is that no user wants to stay there longer than the call they were trying to wrap up 20 minutes ago. It’s a get in, get out type of product.

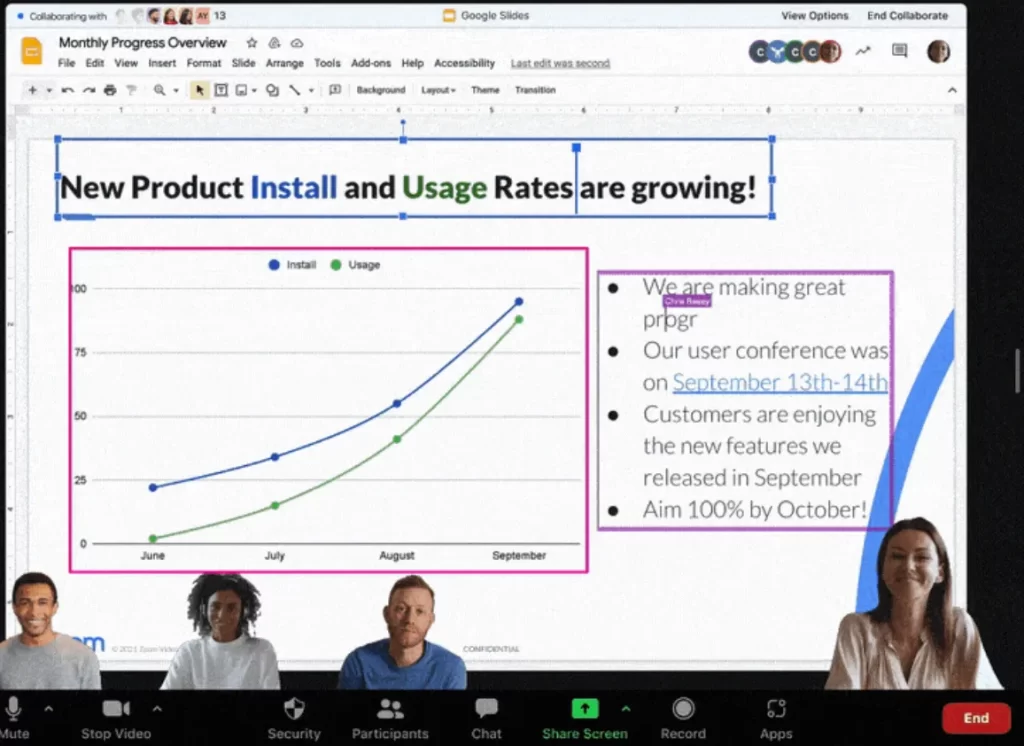

It’s clear that Zoom knows this and in 2019, they started their scramble out of the video conferencing hole in trying to add features that would keep people in Zoom for longer. At Zoomtopia 2019, their product release announcement looked more like a bowl of spaghetti getting thrown against the wall than the Shinkansen building up speed as it travels from Tokyo to Kyoto. There were appliances for Zoom Rooms, there was a chat feature similar to Slack, there was a new calendar to run your life, there was an availability status for each user (as in, are you online?), there was the app store getting a huge push, there were meeting timelines and action items, there were meeting notes (video and voice), yet they were still pushing the angle of it “just works.” These are not all bad features (availability status definitely bad though), some of them are very good (like whiteboards and the immersive apps pictured below). But there is no cohesion to it. They’re going a mile wide and an inch deep. Great products go an inch wide and a mile deep (see Duolingo).

2020 rolled around though and this is where Zoom was briefly saved, and harmed, at the same time. While this desperate strategy of expanding existing users’ time in the product was underway, Zoom was still the only platform that worked reliably. All of a sudden, the market of users went from business meetings of tech forward companies to the entire world trapped at home during Covid lockdowns. And in another amazing technical feat, they were able to scale their infrastructure to handle this.

The problem with adding feature after feature is that it makes the product more complex, and by nature, less reliable. Just like when Samsung added ‘talking’ as a feature of their fridge, fridge repair calls went through the roof; the more features you add to a product, the more chance for errors, bugs and superbugs. So while being handed a temporary Covid gift, some of the cracks started to appear in their product. This was nicely summed up by Ben Thompson on Stratechery (speaking of mistakes the company and product had recently made):

“A genuine oversight”, just like Zoom “mistakenly added our two Chinese data centers to a lengthy whitelist of backup bridges” (link), or “incorrectly suggest[ed] that Zoom meetings were capable of using end-to-end encryption” (link), or “implemented the ‘Login with Facebook’ feature using the Facebook SDK for iOS (Software Development Kit) in order to provide our users with another convenient way to access our platform” without being “aware…that the Facebook SDK was collecting device information unnecessary for us to provide our services” (link), or secretly installed a local web server on Macs without “an easy way to help a user delete both the Zoom client and also the Zoom local web server app on Mac that launches our client [which] was an honest oversight”, and “misjudged the situation and did not respond quickly enough” (link). Every single quote and link is from the Zoom blog.

https://stratechery.com/

I’m speculating as to whether or not the hundreds of new product features being added in 2019 resulted in these issues; it may have been due to the extreme load of new users. However, for a product that prided itself on one thing and one thing only – video communication working – it’s a bad look for the product.

It’s now 2024, and Zoom have a bigger problem than they had in 2019. They’ve captured a large portion of their market, it’s a stagnant market and there are fundamental human nature reasons why this market is unlikely to increase quickly. But they’re still a great company, with a genius founder, amazing talent, have lots of cash and are a phenomenally well-run business. Let’s assume they want to start sending that share price back up. What do they do?

Can this highway move uphill?

A few options to think about

Missions and visions are very founder led and I hesitate to suggest this for that reason, but one option is to change the mission. They could focus on delivering happiness, rather than being so tied to video communication. Product teams in a fast moving, product-led culture should constantly be thinking of the business’ mission when building product. As such, at Zoom, they’ll only be looking for opportunities within video conferencing. While they could maintain their core business around video, this would enable them to expand into new product opportunities. It’s extremely risky given how much value they have in their brand – a brand that’s directly related to video conferencing. However, it opens up the potential for a rapid increase in addressable market.

Another option would be to go down the video conferencing tech stack and build APIs for each component of the video call. So they could develop a building block for audio processing, signal processing, reducing background noise and more. Then they could sell these components to new video conferencing based startups. It would mean new startups could innovate quicker and potentially expand the video conferencing market, with Zoom monetising every user. However, it leaves Zoom’s stranglehold on the videoconferencing market in a vulnerable position. If the market wasn’t to increase, they’ve all of a sudden opened themselves up to massive competition.

A final option may be to build video conferencing for very specific use cases, like they have with IQ for Sales. There are plenty of other specific use cases that they could get into. Online doctor visits for example have a very different set of needs compared to the sales teams around the globe, and a real estate agent has a totally different set of needs again. They could build for these specific user personas which is likely increase retention and help them capture even more of market. This issue with this still being that the market is limited.

What would I do?

I like taking big bets. Plus, you know, this isn’t my company (and I’m not a shareholder) so the consequences of me making the wrong call are nil. I’d actually combine two of the changes I mentioned above.

- I’d change the mission to focus on customer happiness.

- I’d be honing in on specific niches and building Zoom for each user persona.

Following the lines of Zoom for Sales, and OnZoom for online event hosting, they could extend this to Zoom for HR managers and Zoom for Doctor consultations – each user persona actually has quite unique needs. Given the new mission guiding the product teams, Zoom could end up with great video conferencing products for specific users (thereby maintaining, and hopefully increasing their market share) as well as finding new problems that these users have to build great new products.

Should they find an opportunity for a product that will solve a problem for one of these personas that’s not in video conferencing, they’d be wise to think long and hard about using the Zoom brand, or spinning up a startup out of Zoom to attack it. Yes, I think both of these options should be thought about with great consideration.

Let’s look at Zoom for HR as an example of a new product, and how a PM might start thinking about it.

Zoom for HR and interviewing

First of all, let’s assume that (for reasons mentioned above) Zoom are looking at increasing the average time that a user spends on Zoom. This is the metric that we’re going to spend the next year trying to increase, knowing that we can monetise it later if we succeed. Now let’s think about what we can do for a big user group in one of their important workflows – HR managers and the interviewing process.

Think about what goes into an interview:

- There’s the pre-interview – the job descriptions, the candidate filtering, the organisation of candidate timing, plus collecting all the data on each candidate.

- There’s the interview – the questions you want to ask and info you want to find out.

- There’s the post interview – the discussions and rating of candidates and the thinking of whether they progress.

This is only the interviewer too. The interviewee is another kettle of fish. How much of this process does Zoom involve themselves in? Barely any. They’re just the platform that a hiring manager may or may not choose to use to meet candidates. With Zoom for HR, they could be the most essential tool to lean on through the process. This could extend to both interviewer and interviewee. For example, rather than going to Greenhouse to record the thoughts on the interviewee, the interviewer could log that all in Zoom. Rather than practicing with a family member, an interviewee could practice whenever they want in front of an AI talking agent (Zoom should buy Yoodli which does exactly this).

Because the mission is not tied to just video conferencing, these types of add-ons seem perfectly natural – as long as they keep making the customer happy. And because they’re making the customer happy, the customer will be spending more time on average on Zoom.

As a PM, how do we testing whether this is a worthwhile path to go down

Now we’ve decided that this makes sense on the business and customer side, how do we go about testing on the product side whether this is something that we should pursue. I’ll look at it step-by-step.

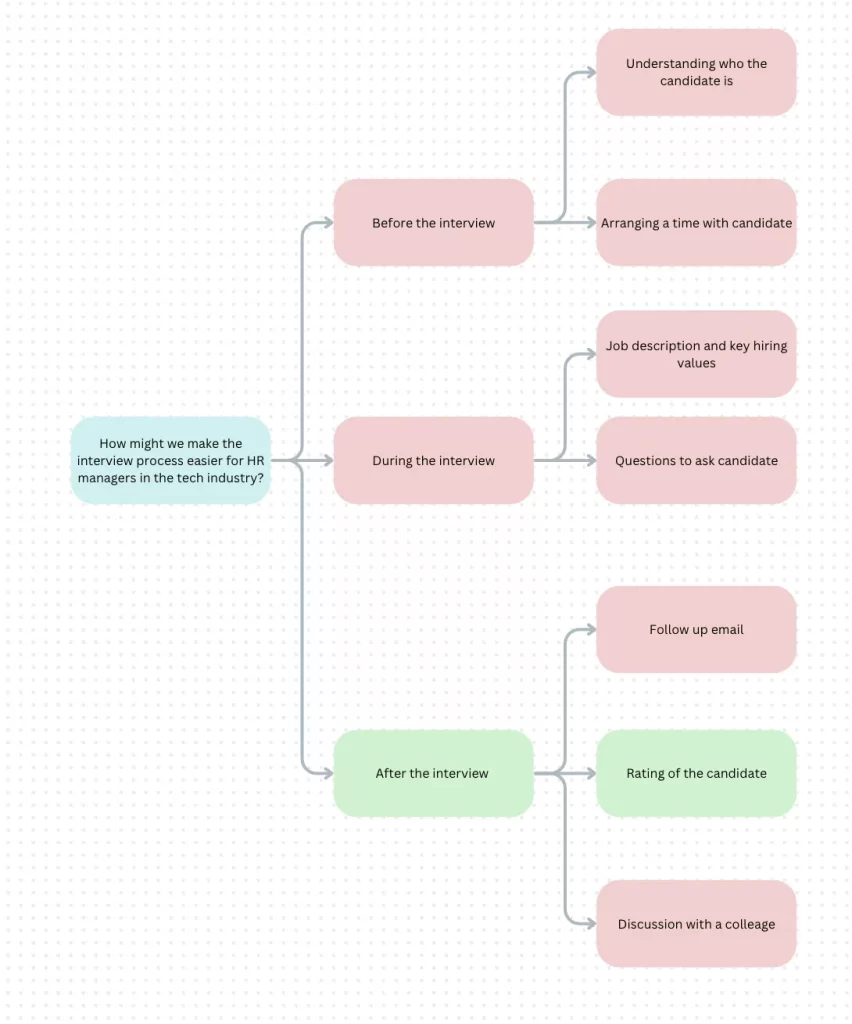

- Define the problem and select the user persona you want to target the new product at. For example, how might we make the interview process easier for HR managers in the tech industry?

- Break this problem down to understand the root cause. We can use the 5 whys or logic trees here to break this big problem down to something more specific, and therefore more actionable. Let’s take a quick look at how logic trees can do this: start with the problem and try and break down the entire workflow in small components, and then try and break those parts down. The second step of the logic tree should cover the entire process defined in the problem (MECE for any consultants reading this). Compiling a logic tree requires great thought, but will be extremely valuable to do (I’ve done the opposite here – a very quick and dirty attempt at it. Still, I hope it gets the point across). See below for the output.

- Now we can brainstorm ideas on this very narrow part of the problem – the rating of a candidate after the interview. In every brainstorm, it’s best to go for quantity over quality. Once we have 15 to 20 down, we can plot them on a 2 x 2 where ‘ability to influence’ is one axis and the other is ‘potential impact’ is the other.

For the purposes of this, let’s say one idea was for Zoom to prompt the interviewer immediately following the call ending on 5 key criteria they were looking for in the candidate, which would be stored in Zoom. - We can now form a hypothesis and state what we’re aiming to achieve. A common and useful way to frame it is “we believe that we will increase the average time that HR Managers spend on Zoom by 10% if the interviewer is given follow up questions immediately following an interview and a place to store the information on Zoom.”

- Next, we need to think about what assumptions are underlying the main ideas we want to investigate. One example is we assume the interviewer will actually trust Zoom and answer the questions. Another is will they go back to look at this information?

- This is when the fun starts. We can design specific tests around each of those assumptions (ideally in ranked order of potential to pull apart the whole idea → probably doesn’t matter). The testing can occur in many forms – MVP, concierge test, fake door test, surveys and so many more (a useful book to help you here is Testing Business Ideas). What we’re looking for is to test the riskiest assumptions as quickly as possible. If we can prove that the assumptions are in our favour, we can progress in building the product with a lot more confidence.

To follow on the thread here, we can send the interviewer to a Google Form to complete some questions, and store the answers in a Zoom branded home page built on a no-code tool or Figma. We’d then send a follow up email 24 hours after the interview telling the interviewer to check their notes. We might set a goal of at least 20% of customers clicking on this and interacting with the information. - Once we run tests on enough of the assumptions, we should gain the confidence to build the feature and this can form the basis of the new Zoom for HR managers. It would be wise to keep this in beta with selected users until the product has enough meaningful features to release ZoomHR.

There you have it, I’ve just changed the mission of the business that Eric Yuan has spent his life building, torn apart the strategy that has made it one of the most loved products in the past decade and then outlined a potential way to start looking at these changes as an individual PM. Clearly I have no right to do this, but I also don’t think the share price will be changing dramatically with the business’ current model. With these changes, maybe we could make it a $50B company in the next few years (or it may go to 0).