The Product Probe: Strava

Given how quickly tech products can move, I believe it’s worth pointing out when this was looked at. It was in 2020.

Strava is an app that you rarely hear about until your 30s, then it’s the only thing you hear about. It’s addictive, but you don’t have to feel guilty using it, because you’re getting fitter when you log on (sort of).

Their mission and vision

Strava’s mission is “to build the most engaged community of athletes in the world.” They define an ‘athlete’ as anyone who registers an activity, from a casual walk around the park to former Tour de France winners.

What are the problems Strava solves?

They have enabled connection between people based on their fitness activity. Not only existing friends, but even vague acquaintances and your new crush at the running club. Hell, even the guy you awkwardly cycle at the same pace as for 20kms can become your new connection, and future BFF.

Strava also helps people stay accountable to fitness goals – where once you had to do that yourself, can you believe!? Gone are the days of sticking motivational quotes up on your bedroom wall to drag you out of bed.

How it works?

While you can record your activities directly on Strava, most users connect an existing GPS device (like a Garmin, or Fitbit). From there though, you literally don’t have to do anything more than:

- Workout; and

- Turn you Garmin on (and off).

Once you finish your workout, it’ll be stored and shared to your followers – just like magic!

Key insight

Making fitness social is not only good to keep you accountable, it’s a great way to strengthen relationships. (Talking about the weather is great chat. But if you ever need a changeup, your latest activity might be the thing!)

A key product insight early on was the understanding of how competition drives its users. This deep understanding of the customer led to the development of critical features like segments and leaderboards. Not only were these parts of the product engaging for existing users, they were a key growth driver for new users.

Think of cyclists (their first users) riding – almost always in packs. Think what they talk about in these packs – cycling and themselves (sorry cyclists). When a group of cyclists want to talk about cycling and themselves, what better way than talking about the record they just broke on the course they’re riding?

Building in this distribution to a product is crucial for long-term success. It’s not enough to be product-led only these days, as Packy McCormick says, “product-first with built-in distribution is the new model.”

Why now?

Not every business needs a strong ‘why now’ (read more about ‘why nows’ here) but it’s clear that Strava couldn’t have started at a better time than it did (2009). While the early adopters would use the program on a desktop, any sort of fast growth was going to be facilitated by ease of use – the iPhone (coincidentally released in 2008).

The great thing about Strava is that you sign up, connect an existing device via bluetooth to your mobile and within a minute, you’re an active user.

Now at 80 millions users and counting, the power of their network effects is creating a decent moat for the business. I’m not convinced it’s crossed the finish line yet, but a new product would have to be pretty spectacular to take significant market share.

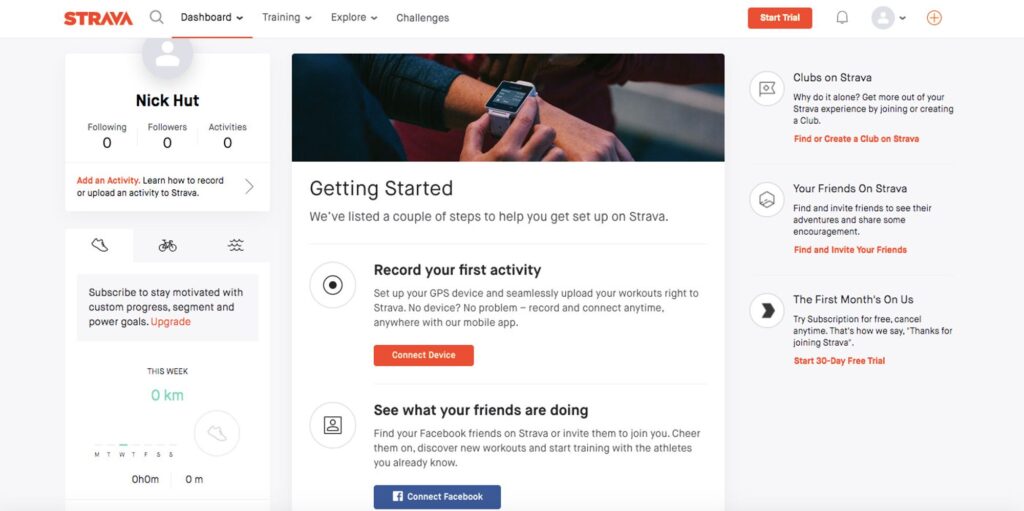

The sign-up process

A smooth sign-up in any app is essential, and Strava gets it right. While it needs to be quick, the app also needs to show something to make the new user love the product as quickly as possible. I don’t know the key metrics at Strava, but connecting with friends immediately would have to be a good indicator for future use. On top of that, Strava would benefit by you connecting a device and uploading activities. Throughout the fast sign-up process, they clearly push you towards these ‘milestones.’

And just in case you don’t do any of these things in the sign-up, the next time you log in, they’re smack bang in your face.

Who are the typical users and their use cases?

The typical user is an active person who exercises at least 3 times a week. I would expect them to also be social people, and be a professional worker with an above average salary. This is based on users needing other devices to complement Strava, and key sports on the app attract higher income participants (ie. cyclists who are known to spare no expense).

It also targets itself at these ‘more serious amateur athletes’ compared to competitors. If you’re looking at it through the jobs-to-be-done lens, they’re hiring Strava to be a workout buddy, a motivator and an inoffensive way to connect with fellow ‘athletes.’

Typical use cases are:

- Someone training for an event they’d never done before, and wanting to be held accountable;

- Someone looking to lose weight;

- A competitive athlete looking for people to compete against, virtually.

Why do I love it and what problem does it solve in my life?

I started using it follow my friends and see what exercise they did that we didn’t previously talk about. More recently it’s a great way to connect with new groups that I’m running with, and solidify a friendship.

Market and trends

It’s a social network first and foremost, and its community of users is its biggest asset. This is something that competitors cannot easily copy either. But what is the market size, and potential for revenue growth?

If we classify it as a social network of ‘active people,’ let’s do some back-of-the-envelope calculations for the number of people classified as active in the world. Out of my friends, probably 40% would classify themselves in this category. Given I’m one of them and most my friends have come through playing sport, I’d say the average around the world is closer to 20%.

Around 65% of the world is aged between 15 and 64. In that aged bracket, over 90% have the internet and a smartphone. Given the issues mentioned of requiring other devices to support Strava, this number will be reduced – let’s say 60% of those have the means to join. So 7b * 20% * 65% * 90% * 60% = ~500m.

Currently they have ~80m users, so > 10% of the total market is decent penetration. They still have room to grow here too.

Looking at another perspective, the cycling industry is worth around $6b a year in sales in the US and $55b in the world. Running gear is worth over $500m a year in the US. Either way, these are big markets, but not mind-blowingly big. I believe some real growth could come from entering new markets which I’ll talk about below.

Value creation and value capture

One factor I love to look at (which is currently subjective) is the net creation of value for society from a product.

Does Strava create net value for society?

It encourages more people to exercise, and connect with each other doing this. Both factors contribute to boosting happiness, improving positivity of mind and increasing life expectancy. So it’s hard to argue it doesn’t create net positive value for society.

While yes, any computer software does leave an environmental footprint, this would pale in comparison to the positive. There have been some privacy issues early on as well, but they were proactive on getting on top of this, and have actually not just fixed the issue, but gone above and beyond with recent feature updates.

But does Strava capture this value?

Revenue model

Strava has two main revenue streams – the paid version of the app (~$50 a year), and advertising. I would assume the subscriptions are the main revenue driver. Recently (2019), they cut out a middle tier of subscription option and made the feature set for free users much smaller. It was a very interesting move showing they’re not too concerned about their overall user growth. Rather, they’re prioritising the bottom of funnel conversion. It’s an interesting move for a business relatively early in its growth.

They also make money from advertising, and it’s done incredibly well. Where you see ‘sponsored challenges,’ that is advertising. I appreciate how well that’s done because you can go to the app and not feel like you’re being marketed at. But given the subtlety, and the relatively small user base (for a social media app), I doubt it’s the leading contributor to revenue.

So it’s a pretty simple revenue model and it has been estimated at $72m in 2020, while not generating a profit at this stage.

Second-order effects

More people logging their activities brings about a deluge of data. A fascinating point about Strava is that it is now one of the leading tour guides apps for active people. While many think of exercise and holiday as an oxymoron, I can assure you many people still like to go for a run in new cities.

By accumulating the most common activities people do in each city, they’re able to share these routes with everyone else. So now the runner who has never been to Barcelona but did bring their new Nike Hokka’s, will be able to quickly find a beautiful track to follow. Just like Airbnb helps you live like a local, Strava can help you exercise like a local!

Alternative products/solutions

There are a lot of companies in the social and fitness space, each with a slightly different angle and following. Some of them are:

- Garmin

- Runkeeper

- Mapmyrun

- Edomondo

- Runtastic

- And even the good old Excel spreadsheet for people who still track their times in there.

Future growth

There is still significant room for growth on the free and paid subscriber side (and increasing the percent of free : paid). But to get to the next level, I think they’ll be looking for alternative markets. While still staying true to their mission of building the most engaged community of athletes in the world, other add-ons could include:

- Product promotions (shoes for example)

- Connecting people with trainers, groups and PTs.

- Travel guide for people in areas other than their home cities.

- Event (runs, bike events, triathlons etc)

The big one though, is the data they’re accumulating. This could be a vital part in health and science studies in years to come. On the Rich Roll podcast, the founders tell a story of how a Strava user was able to identify a severe heart issue they had by looking at the data on Strava. While multiple doctors couldn’t discern any problem, the user kept pressing based on the heart rate stats.

Turns out, he needed a triple bypass – and Strava has saved this man’s life. With the billions of activities being uploaded by people of all types of people, there has to be more in this.

Currently, they track 33 activities and they should look to expand this. Encourage users to upload as much of their life as possible, and Strava should be able to meaningfully contribute to field of health science.

What would I do to improve it? What metrics would I be looking for to show this improvement?

If being a product-led business with distribution baked into the product wasn’t a big enough sell for you, then add on a platform and you’ve got the holy trinity of product-land. (Read more: The Power of the Platform).

This would be a place where trainers can video-coach athletes either 1:1, or release videos of training sessions to a general platform on Strava.

It would initially be used to target the ‘professional/amateur’ user – the people that pore over every session and have races coming up. The user would benefit by receiving new sessions that will take their times to the next level (we all know the secret trainers out there).

The content creators could build these specific programs and earn a new source of revenue, or grow their connections. And by taking a cut of each transaction, Strava could earn a new significant source of revenue.

There would be many issues to consider including how to monitor the programs being legitimate, and right for the individual.

However, I’d be looking for increased time spent on app, new user by referral and number of transactions going through the app to confirm it was working well.